War economics #1: Where to keep your money in the time of war?

The things below are very easy and simple and self evident. You should not even spend time to read them. Just do them. That’s it.

Also these apply both to your personal and company assets.

Since I burnt myself early on in this wartime (as of February 2022) – yes I had deposits (luckily less than 5% of my all assets or even less) at Sberbank that have just declared bankruptcy – I made additional steps so as I will not want to see the next big meltdown without any protection.

Also I talked to several refugees from Ukraine with all what they have are 2 bags of clothes and their passport. They have access to funds at home from where they can withdraw about €6 per day. It is an unbelievably terrible situation to be in.

Hence I wrote this article.

Please donate for Ukraine before you read on

Before you read on – please donate to Avaaz – they are a well known help organization who collect money for good causes and pay out 100% of what they receive from donors like you.

Now they do it for Ukraine:

Donate for Ukraine through Avaaz

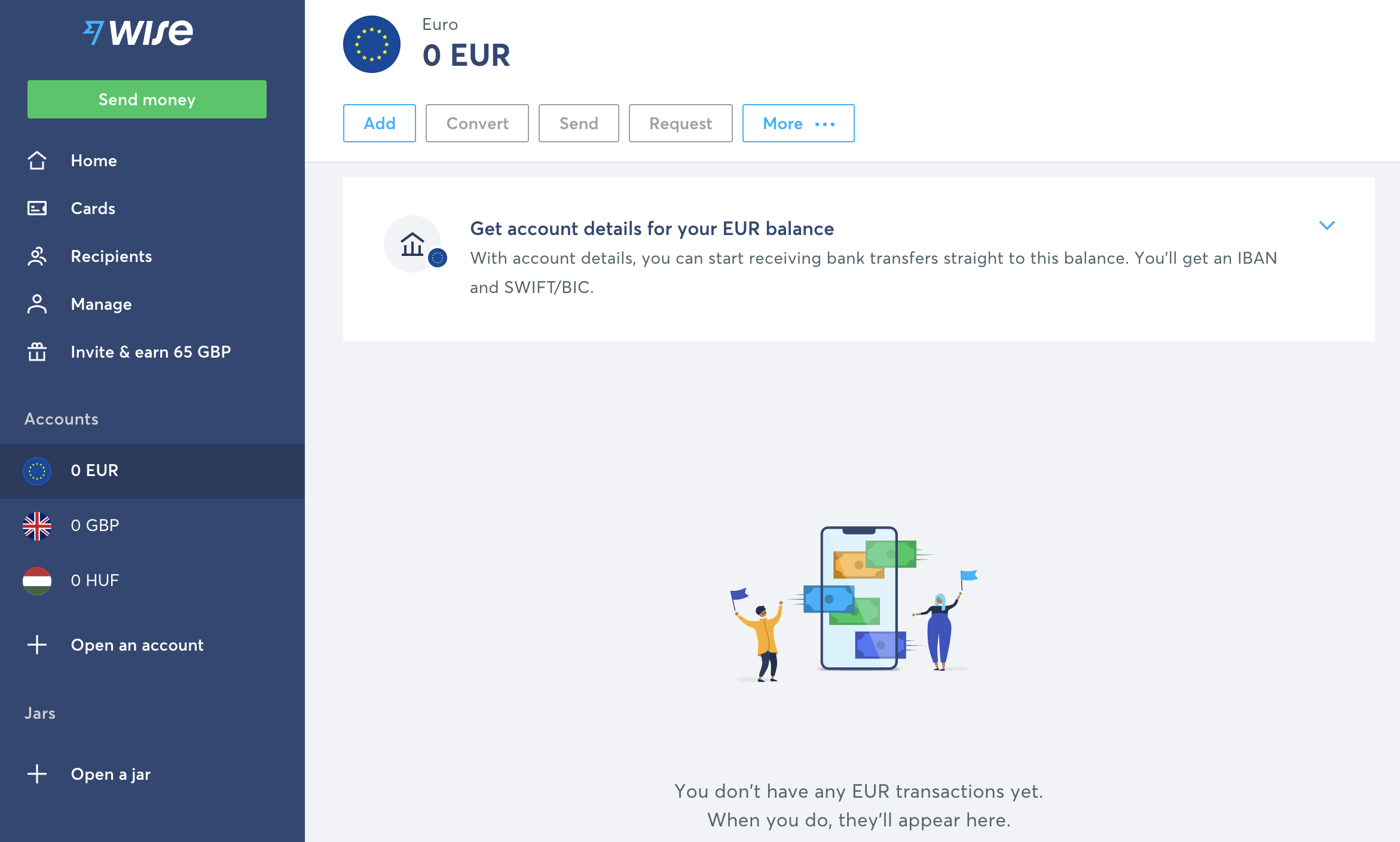

Update 7 March 2022 – Revolut has a banking licence in Lithuania – you can transfer your Revolut money to Revolut bank in the app with one tap/click

From the September 2022 Revolut obtained a banking licence in Lithuania – you can transfer your money to Revolut Bank with one tap/click in the app – so your money is protected up to 100 000 EUR by the Central Bank of Lithuania (or similar). It sounds great. But: Revolut has 18 Mln customers.

Let’s assume only 10% goes for the “transfer my money to the bank” option. 1.8 Mln customers x (let’s assume) 10 000 EUR = 18 Bln EUR to be paid. The total state budget of Lithuania is around 14 Bln EUR. You do the rest of the math. Revolut has overgrown Lithuania – a lot.

When it comes to money, 2 things matter: assets and income

1-assets: things you have and worth money – these include money you have, gold, cars, properties, businesses

2-income: money you regularly get (e.g. monthly) – these include salaries, rental income etc.

Also – notice that assets can produce income in 2 ways:

a) regular income: you use or rent out the asset

e.g. you have a flat and you rent it out; you have a body and you go to work with it

b) one time income: you sell the asset

e.g. you have a flat and you sell it; you have a body and… (you finish this sentence -> e.g. selling your kindey; it is not that funny, actually)

You can remember easily

assets and income as chicken and egg

You think I am kidding?

Hell not.

A chicken is an asset, eggs are the regular income.

Or you can sell the chicken in one.

You complete, again, this last sentence. And shed the blood of the poor chicken.

I will not. I am vegetarian.

You need to protect which? The egg or the chicken? The chicken, of course. So let’s see how to protect your chicken = assets.

In time of war 3 things change

1-Fear, anxiousness is up.

2-Perception, beliefs have more importance vs rationality

3-Things that affect your income and assets happen much much faster

1-Fear, anxiousness is up

Fear is eating into everyone’s minds. Especially when war is near, or in a similar country or the threat is valid and vivid.

This is the foundation, the source of everything else that is happening.

Side-note: the smell of fear is real – do NOT read this article; it does not add to the topic. It is just interesting. But you will click anyway, with 70% probability.

People switch from abundance mindset to scarcity mindset.

| Scarcity mindset | Abundance mindset |

| I do not have enough | I have enough |

| I need to keep it all for myself | I can share |

| I do it alone – it is so urgent, I cannot explain it to others or coordinate with others | I can collaborate, I have time, I can explain and collaborate |

| I win | Win-win |

| I have all the answers – I do not have time to learn | I can learn |

| I did it | We did it |

| Dictate | Ask |

| I fear if things will get worse I will be amongst the losers | If things get worse we can still win together |